Nobody can predict the future, but our AI puts the odds in your favour.

Stock price prediction using AI and Machine Learning helps investors to discover the future value of stocks, cryptocurrencies and other financial assets. In our research, we used SENTIMENT Lab to extract information from news delivered by global providers and social media platforms, confirming that articles and messages are strongly correlated with financial markets.

Seven Real-World SENTIMENT Lab Analysis Use Cases

Case #1 – Credit Suisse shares (CSGN)

On March 15th, 2023 Credit Suisse shares (CSGN) in Switzerland fell as much as 30% and hit a fresh all-time low, reflecting increasing concerns about the bank’s struggles to stabilize its operations. 👉

In the previous weeks, the stock negativity score calculated by SENTIMENT Lab was extremely high (8 out of 10), anticipating (and predicting) the stock price drop. 👇

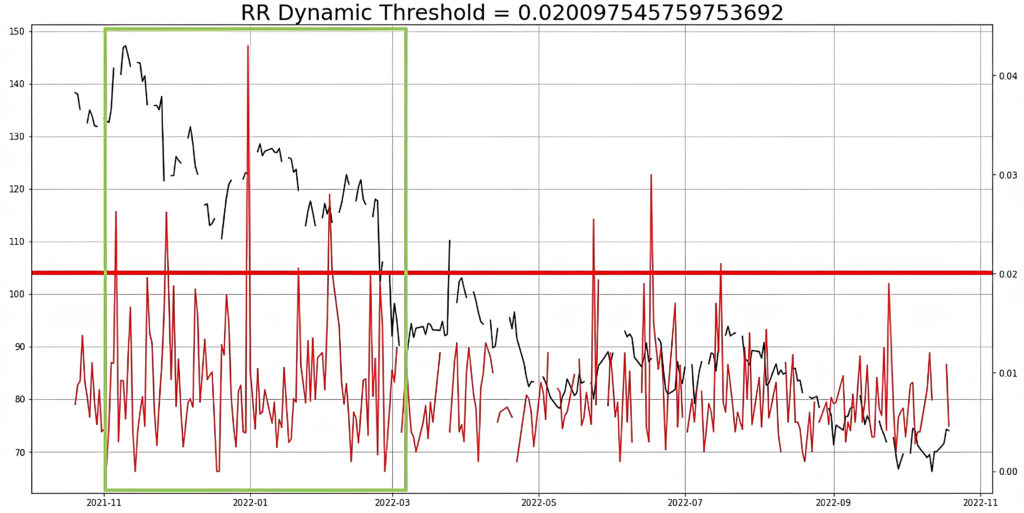

Case #2 – Rolls-Royce Holdings plc (RR.L)

Between November 2021 and March 2022, the negativity score for Rolls-Royce Holdings plc (RR.L) reached four peaks, exceeding the dynamic alert threshold (2.01). The stock price fell drastically in the following weeks (-40%).

Legenda

— Negativity Score

— Stock price

— Dynamic Threshold: 2.01 (Dynamic threshold is calculated for each financial instrument on monthly basis with backtesting techniques)

Analysed world news: 5’136

Period: November 2021 – November 2022

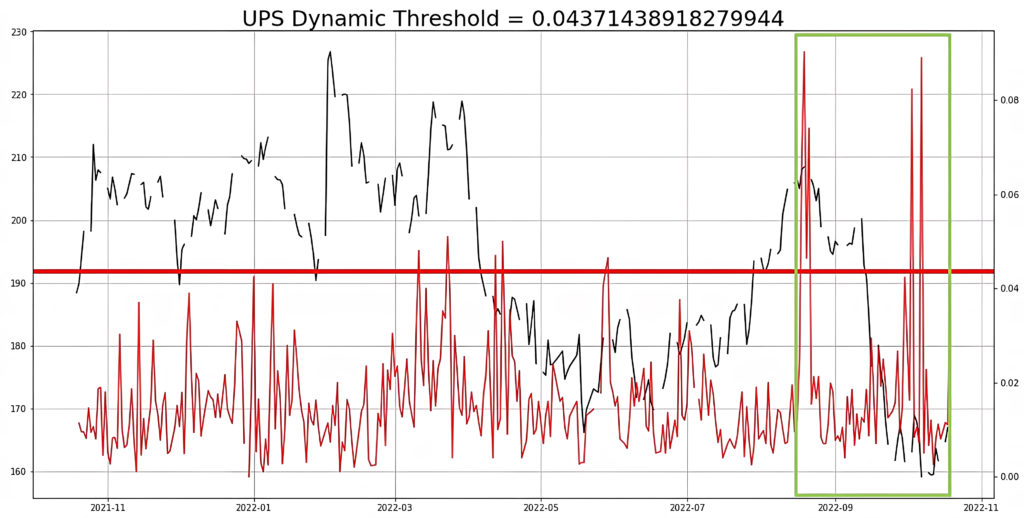

Case #3 – United Parcel Service Inc. (UPS)

Between August and October 2022, the negativity score for United Parcel Service Inc. (UPS) reached three peaks (>8 out of 10), exceeding the dynamic alert threshold (4.37). The stock price fell drastically in the following days (-25%).

Legenda

— Negativity Score

— Stock price

— Dynamic Threshold: 4.37 (Dynamic threshold is calculated for each financial instrument on monthly basis with backtesting techniques)

Analysed world news: 6’592

Period: November 2021 – November 2022

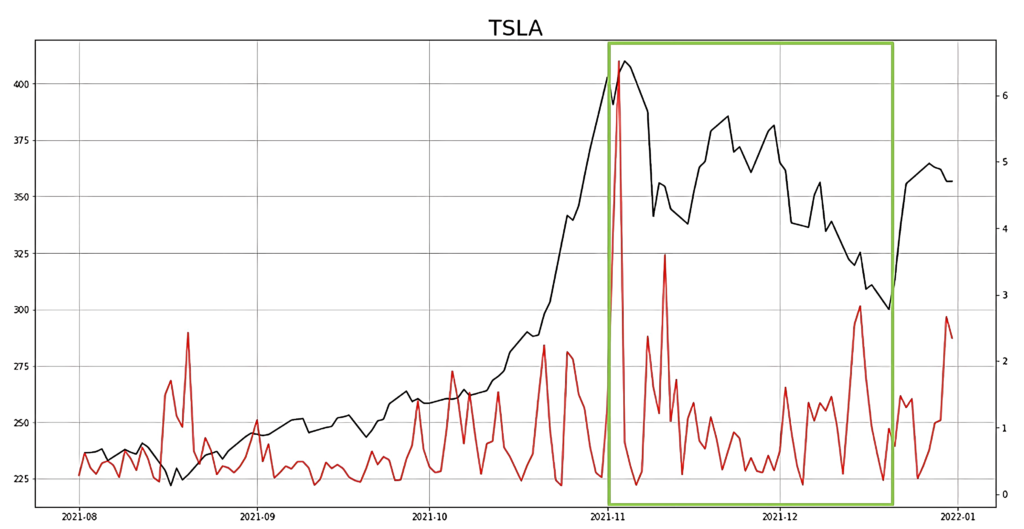

Case #4 – Tesla Inc. (TSLA)

Between August and November 2021, the negativity score for Tesla Inc. (TSLA) remained low (<2 out of 10) and the stock price grew steadily. In November 2021, the negativity score reached a peak (>6 out of 10) and the stock price dropped drastically in the following weeks (-25%).

Legenda

— Negativity Score

— Stock price

Analysed world news: 7’587

Period: August 2021 – January 2022

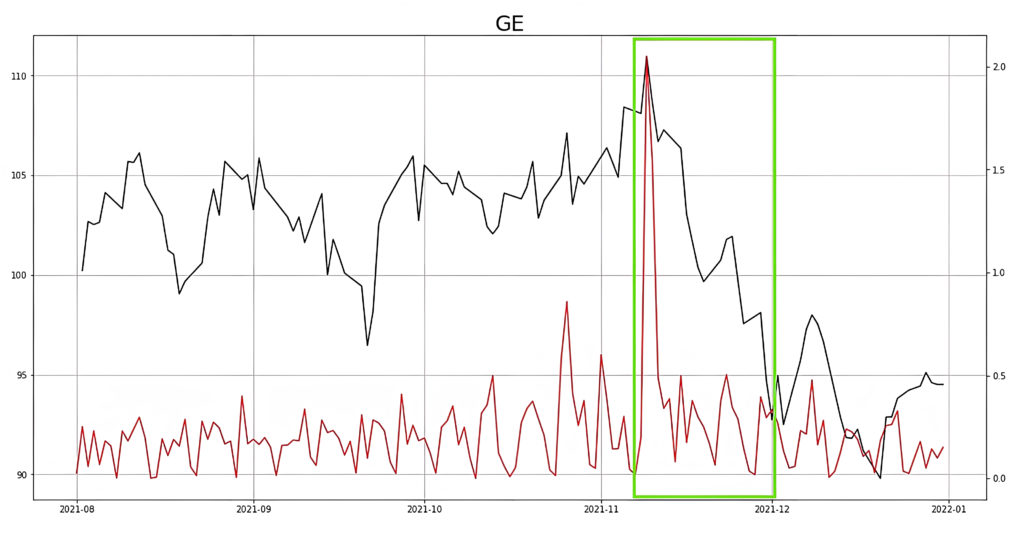

Case #5 – General Electric Company (GE)

In November 2021, the negativity score for General Electric Company (GE) reached a peak and the stock price dropped drastically in the following days (-15%).

Legenda

— Negativity Score

— Stock price

Analysed world news: 4’099

August 2021 – January 2022

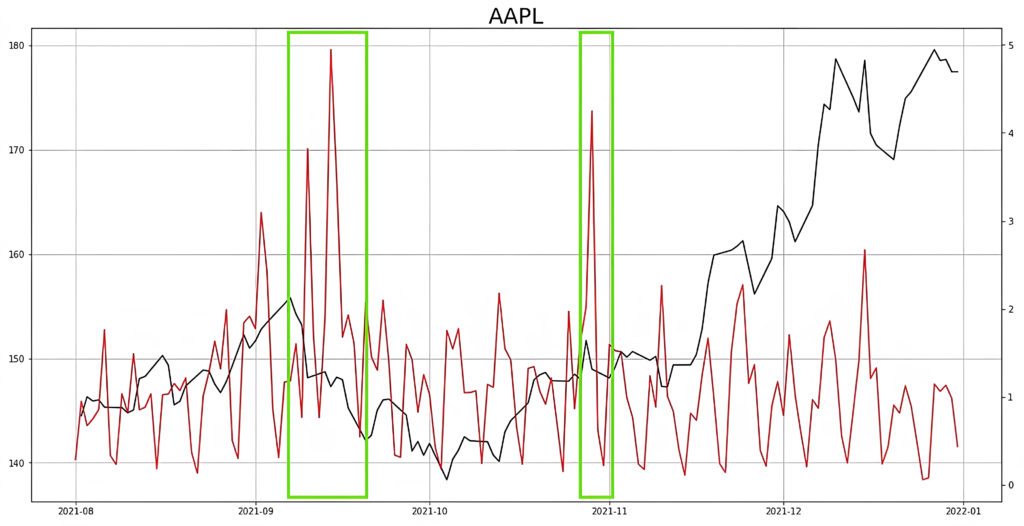

Case #6 – Apple Inc. (AAPL)

In September 2021, the negativity score for Apple Inc. (AAPL) reached two peaks and one peak in November 2021. In both cases, the stock price dropped significantly in the following days. Between December 2021 and January 2022, however, the negativity index remained low and the stock price grew steadily.

Legenda

— Negativity Score

— Stock price

Analysed world news: 14’015

Period: August 2021 – January 2022

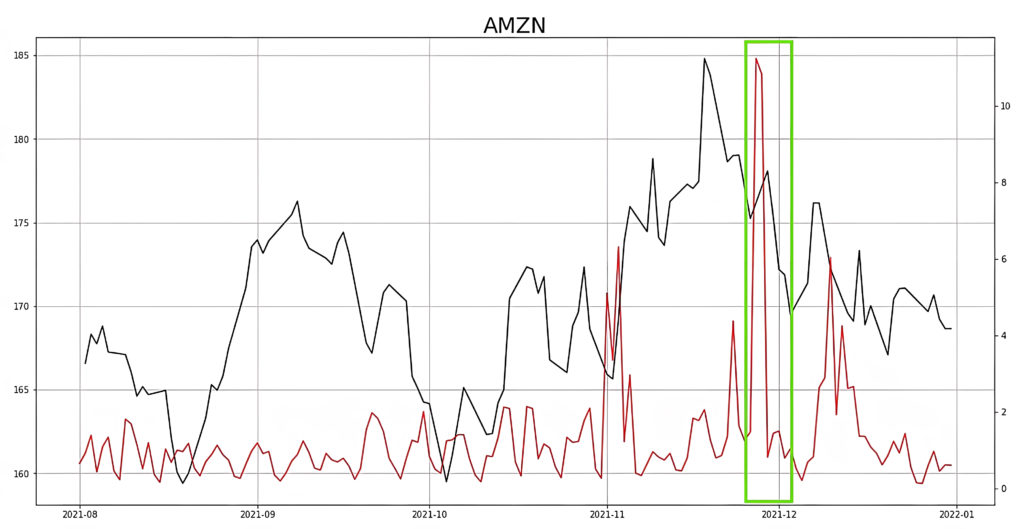

Case #7 – Amazon.com Inc. (AMZN)

In December 2021, the negativity score for Amazon.com Inc. (AMZN) reached a peak (10 out of 10) and the stock price dropped drastically in the following days (-15%).

Legenda

— Negativity Score

— Stock price

Analysed world news: 11’275

Period: August 2021 – January 2022